Pegged Currencies

White papers

About pegged currencies

While many currencies in the world work under a floating exchange rate regime, where the currency price of a nation is determined by supply and demand on the open market, some other countries adopt fixed or pegged exchange rates against another currency.

Countries commonly establish a currency peg regime with a stronger or more developed economy so that domestic companies can access broader markets with less risk.

Pegging a currency stabilizes the exchange rate between countries. Doing so provides long-term predictability of exchange rates for business planning.

However, a currency peg can be challenging to maintain and distort markets if it goes far from the natural market price.

Such systems have proven to reduce the volatility of currencies used in developing economies and have placed pressure on governments to be more disciplined with monetary policy choices.

The U.S. dollar, the euro, and gold have historically been popular currency pegs.

Version 10.1 update

Prior to this version foxer used to calculate pegged values strictly following the currency peg from the configuration file, even if a value was provided from a Central Bank publication.

From version 10.1 on we have decided to stick to provided values, when they exist. Cases of this circumstance are found on the following plugins:

- European Central Bank (ECB) : Bulgarian Leva (BGN)

- Bank of China (BOC) : United Arab Emirates Dirham (AED)

- Banco Central do Brasil (BCB) : Bulgarian Leva (BGN) / Cape Verde Escudo (CVE) / Comoros Franc (KMF)

These exceptional cases are now made visible, along other useful visual information, thanks to the new currency coloring mechanism, as described in the Main Converter Controls features article.

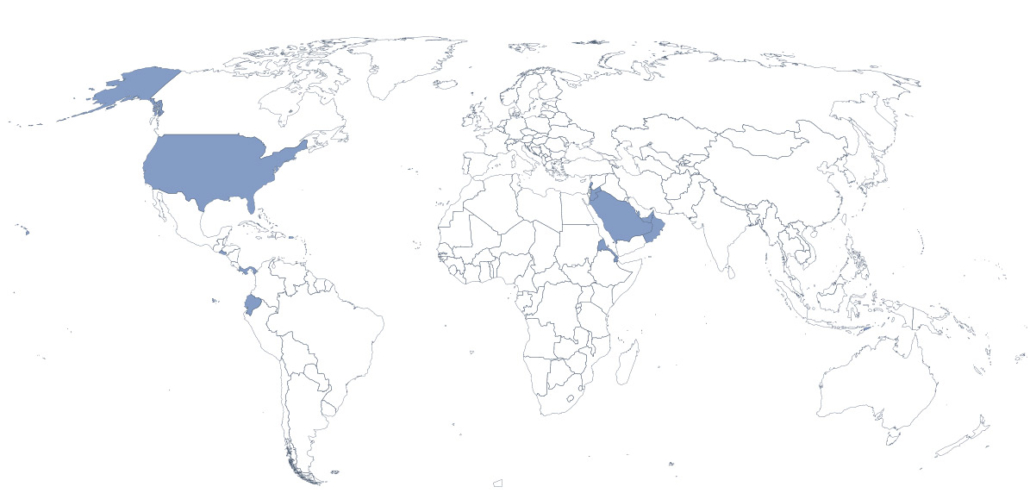

Tables below shows all pegged currencies as they are configured for foxer currency calculator.